Repositioning a brand: nbkc bank

Situation

In 2018, nbkc was a small, branch-based community bank in Kansas City with three siloed business units: deposits, home loans and commercial lending. No centralized customer database existed and the bank had no view into total customer behavior – only product-centric views – and engaged in no cross-selling, had no measure of CX, and no analytics for its website or sales activity performance. Its sales collateral and brand identity were dated and not presenting nbkc as a challenger brand. Underway was an initiative to offer online account opening and digital banking in all 50 states to build deposits at scale.

Action

First, build a marketing team! Then: centralize data from three product databases into a customer-centered marketing automation platform; define nbkc’s desired customer experience, KPIs, and begin surveying with focus on problem resolution & moving “4s” to “5s;” introduce nbkc nationwide with an omni-channel digital campaign tapping consumer distrust of big banks due to unethical behavior, using mnemonics to aid memory of the bank’s brand name: ‘no bank knows conduct like nbkc.’

Results

In the 24 months since the launch of both business and personal online banking in Sept. 2018, nbkc’s deposits have nearly doubled, with a 97% increase in balances. Customer experience surveying began in 2019, shedding light on needed improvements, customer satisfaction and providing ongoing trending data against benchmarks. Brought rigor to tracking and attribution for nbkc’s website and lead gen activity. Centralized database is near completion and a first-ever cross-sell campaign is underway.

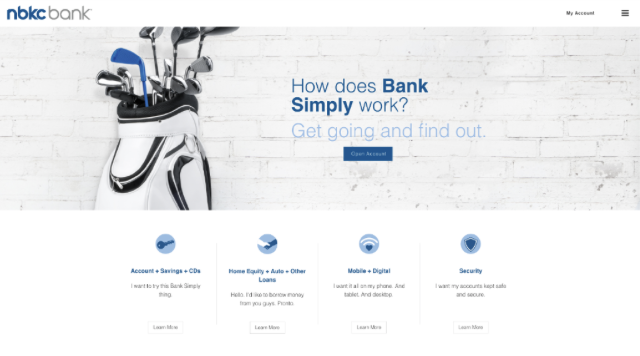

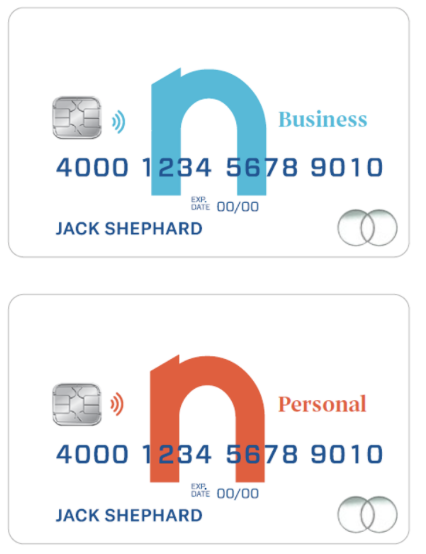

Before

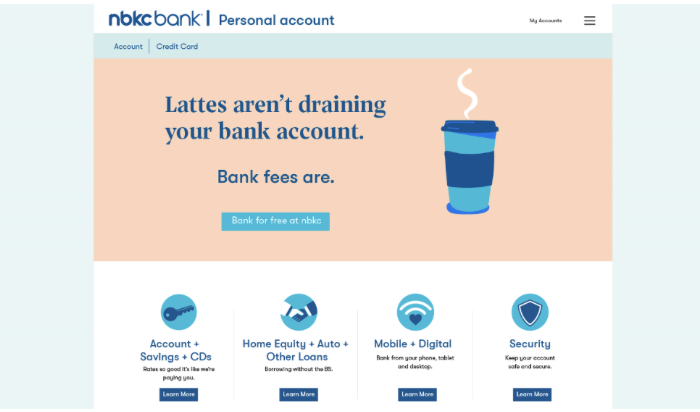

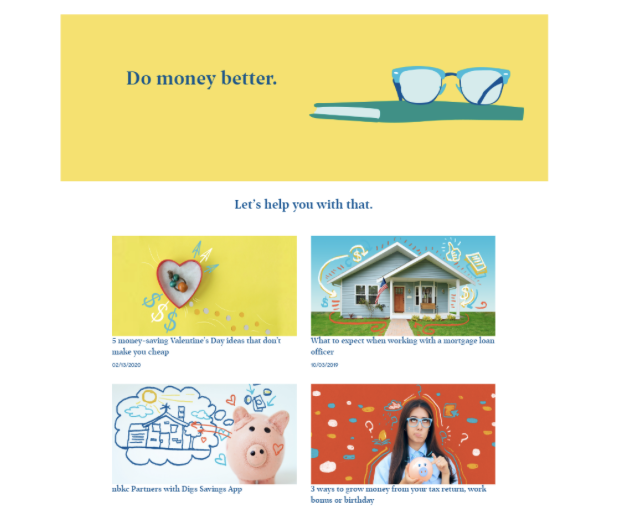

After

Commercials

“The difference between strong content and weak becomes most obvious when you see it done right. Three institutions offering strong content, are NBKC Bank, Tinker Federal Credit Union and Consumers Credit Union.”